You are looking for a bankruptcy attorney in Farmington, Missouri and probably want to find the best attorney for the most reasonable price.

When filing bankruptcy in Farmington, there here are 5 attributes that we look for in bankruptcy attorneys, which are 1) Rate 2) Reviews 3) Relevance 4) Reliability, and 5) Referral. We also care about bankruptcy attorneys who offer free consultations and payment plans.

See the table below for bankruptcy lawyers servicing Farmington. If you'd like to understand the all-in bankruptcy cost in Farmington, we built a free qualification and cost calculator below to estimate fees. Update the zip code if you’d like to refresh the list. Please note that the phone information below will first route to Ascend, and we will check our system for available attorneys who are available for a free phone consultation before transferring you to the attorney. If you'd like to speak directly to a specific attorney below, you should be able to find that information directly on the attorney's website.

| sort_num | guid | has_phone | Firm | Rating | Reviews | Relevancy | Free Consult | Payment Plans | Contact | Click to Call |

|---|

Fill out your information for the local attorney. Please note that the attorney selected may not be the one which contacts you.

Farmington has a estimated population of 19113. What we found is that folks in bigger cities such as Kansas City or Saint Louis like to often have bankruptcy lawyers who are close by. In smaller towns with a population under 20,000, some individuals actually like to hire bankruptcy lawyers far away because of potential angst about other individuals finding out about the bankruptcy hiring.

This is why we built the zip code updater, so you can update the zip code to where you’d like to hire a bankruptcy attorney, which potentially might not be in Farmington.

The bankruptcy attorney fee in Farmington is often based on a number of factors. Here are some of the factors:

We had mentioned earlier the population of Farmington is 19113. As such, larger cities may have higher attorney fees and smaller towns may have lower attorney fees. For example, Springfield may have a lower bankruptcy lawyer fee than Kansas City.

For example, Farmington has a median household income of 45528. So, the income and general cost of living in Farmington may dictate the attorney fees.

Secondly, the complexity of the case may dictate the cost of the bankruptcy. This is often the case with Chapter 7 bankruptcy. Do you own a home? Are you married? In Farmington, approximately 42.8% are married. If you are married and filing with your spouse, you may have additional complexity to the case, potentially in a higher attorney cost. Secondly, are you a home owner? Approximately 56.3% of individuals in Farmington own a home. With positive equity, you often check Missouri bankruptcy exemptions to determine whether you can keep the home. So, if your case in Farmington is more complex, your attorney fee may be higher.

Okay, let’s dive into how the type of case may result in higher or lower bankruptcy lawyer fees in Farmington.

Chapter 7 bankruptcy is the most common bankruptcy in the United States. Of the 10,606 bankruptcies filed in Missouri, my guess is the majority of those are Chapter 7 bankruptcies.

The Chapter 7 bankruptcy is often more simple. You can get a discharge (forgiveness) of debt in as little as 120 days. There’s often only one meeting and potentially less paperwork. Many people become nervous that they will lose belongings if filing Chapter 7 bankruptcy, but bankruptcy exemptions in Farmington can help protect those assets.

As such the cost is often less. In Missouri, the estimated Chapter 7 bankruptcy attorney fee is $1162 - $4800. You can use our free Farmington Chapter 7 qualification and cost calculator to estimate qualification and cost.

Chapter 13 bankruptcy is a payment plan bankruptcy, designed for those making regular income to pay back a part of their debts. The Chapter 13 bankruptcy is often 3 or 5 years, resulting in monthly payments in coordination with the Chapter 13 Trustee in Missouri.

As such, the Chapter 13 bankruptcy is quite a bit more complex, so the estimated Chapter 13 bankruptcy attorney fee range in Missouri is $3,600. The fee may be the same across Farmington because of what’s called a no-look fee, which is a set rate for the reasonable fee for the service provided.

The Chapter 13 bankruptcy fee is often included in the Chapter 13 plan. Before you file Chapter 13 bankruptcy, you may also want to consider Chapter 13 trustee fees, which is an estimated 5.6% - 7.7%%. You can use our free Missouri Chapter 13 Farmington Chapter 13 payment plan calculator to estimate your complete Chapter 13 plan payment, which includes the estimated bankruptcy attorney fees, the trustee fees, and the disposable income calculation.

Free bankruptcy consultations are designed to help you know whether bankruptcy is the best option for you. Because you are in financial hardship, many bankruptcy attorneys offer this service to alleviate the burden of another financial expense.

You can ask questions related to bankruptcy, and you can also get an estimate of what the bankruptcy lawyer fee will be in Farmington. You can also get multiple opinions via free bankruptcy consultations if you didn’t jive with the attorney or you would like to discuss both types and qualification with another attorney.

Yes, many bankruptcy lawyers take a payment plan, and I would estimate that would be no different in Farmington. A Chapter 13 bankruptcy is already a payment plan bankruptcy, so many Chapter 13 bankruptcy lawyers will take a payment upfront and then include the rest in the plan.

In a Chapter 7 bankruptcy, many lawyers will take payment plans, but the total attorney fee often has to be paid before filing. If an bankruptcy lawyer in Farmington will only take all of the money upfront for a Chapter 7 bankruptcy and not provide payment plans, you may be able to find one that does take payment plans.

Just to confirm, you may always want to check which type of bankruptcy you are filing. Some bankruptcy lawyers may offer payments plans or $0 Chapter 13 options, but those may be much more expensive in the long run than doing a payment plan upfront on a Chapter 7 bankruptcy.

One of the most important attributes we look for in a bankruptcy lawyer in Farmington is whether they are reliable. The reason for this is that there are certain deadlines that have to take place, and you need someone who will meet those deadlines.

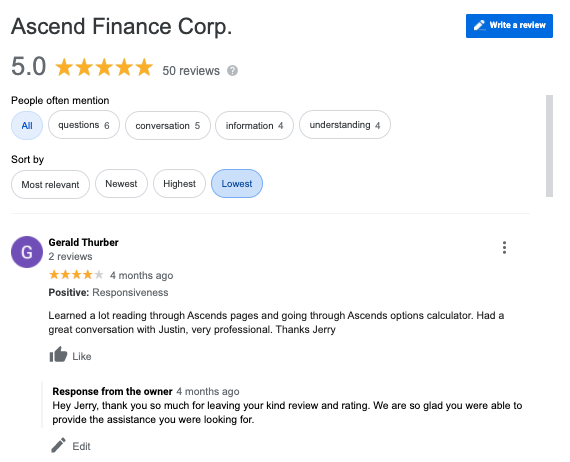

Some of the ways that you can determine this is potentially through rating and reviews because that gives you insight into other clients’ experiences. There are biased review sources out there, so our favorite review sites are Google ratings and reviews and Yelp ratings and reviews.

We like to sort from the lowest review descending so that you can really get a sense of whether this individual is reliable. See the image before of Ascend Bankruptcy Help’s Google reviews (source), with the lowest rating descending.

Filing bankruptcy in Farmington is a big decision, so it’s important to have a reputable bankruptcy lawyer if you decide to hire one.

The purpose of this article was to show you top bankruptcy attorneys in Farmington while providing some insights on how to find a reputable bankruptcy lawyer. For example, you may consider looking at the rate, the reviews and ratings, the reliability, the relevancy, and any referrals to decide whether to hire a bankruptcy attorney. You can also contact us at any time for specific questions about bankruptcy attorneys in Farmington or take our free bankruptcy cost and qualification calculator below.