If you are facing an overwhelming amount of debt, and aren’t sure how to get out from under it, there are a few things you could look into. Things like bankruptcy, debt settlement, and debt management are just a few of the options available to you when this is the case. One prominent option that you have is called debt consolidation. Debt consolidation is a process in which you combine all of your existing debt into one, easy-to-track payment. This is typically done by taking out a new loan. This loan pays off your debts and then you simply pay off the singular loan. There are clear pros and cons of debt consolidation which we consider below. Let’s take a more detailed look at what those pros and cons are. We will also look at credit card refinancing, an option that is similar to debt consolidation.

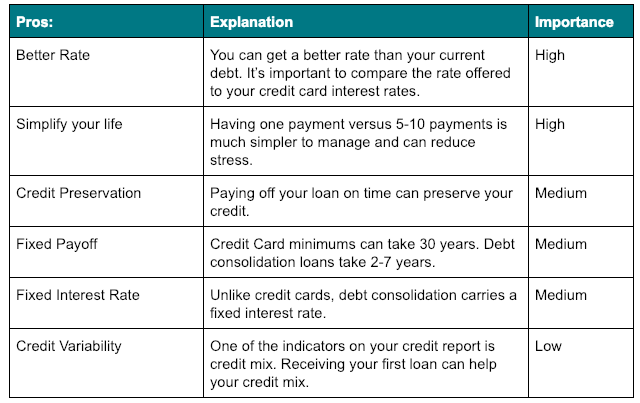

Without a doubt, there are considerable benefits that come with consolidating your debt. They are important to keep in mind when considering different debt relief options. For example, some debt relief companies may offer debt consolidation loans in their programs through companies such as LendingUSA. Here are just a few of the benefits:

1) Better Rate: A lot of times, the interest rates on your current debt can be pretty steep. They also can vary greatly depending on what kind of debt you owe. Oftentimes, debt consolidations have lower interest rates, which can save you money in the long run.

2) Simplify your life: Sometimes you can be juggling anywhere between 5-10 different payments, or even more. That can be difficult to keep up with, especially if payment due dates are sprinkled throughout the month. With debt consolidation, you will have one monthly payment to keep up with, instead of 10 or more.

3) Preservation of your credit: Other options, like bankruptcy and debt settlement, can have a drastic impact on your credit score. Debt consolidation takes all of your debts, rolls them into one, and you make payments until the loan is fully paid off. While there still may be a small dip in your credit score, the long-term impact of debt consolidation is considerably less harsh than other options.

4) Fixed payoff: With multiple debts, it can feel as though you will never get out of debt. Even when you get finished with one debt, there are still others that you have to keep paying off. With debt consolidation, there is a fixed point at which time all of your debts will be paid off. This can be extremely motivating when working towards paying off your debt.

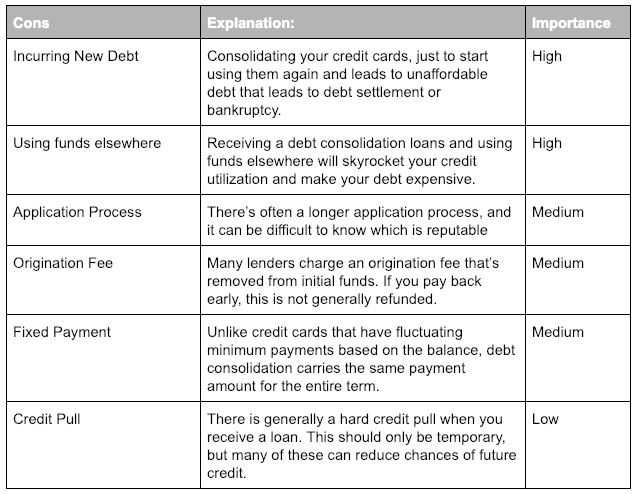

While these benefits are great, we also need to acknowledge that there are some cons that should be considered.

1) You may feel free to take on new debt: If you consolidate your loans, there is a chance that you may feel as though you can continue taking on more debt. The ease of payments may cause you to feel as though you have the capacity to add more payments onto your load. You could end up even worse than you started if you fall into this.

2) Application Process: You have to apply and get approved. If your debt to income ratio is too high, you may not qualify.

3) Other Fees: If your debt isn’t too much, the origination fee and APR may be higher than the existing debt. Look into whether or not it would be worth it to take out a debt consolidation loan.

If you think debt consolidation may not be for you, then there are other options to consider.

There are many different alternatives to debt consolidation, such as mortgage refinancing, credit counseling, debt settlement, and bankruptcy. Debt consolidation can be a good avenue to eliminate debt. However, adding more money on the credit cards initially being consolidated or not using the full funds for the consolidation can be detrimental.

Most people prefer debt consolidation loans before considering debt management, debt settlement, and bankruptcy as those options have more long-term negative effects. If you do get into a situation where you cannot get a debt consolidation loan, here are the main debt relief options:

When considering these options, you will want to know the total costs, length, and pros and cons via a Debt Relief Calculator.

If you have a very specific form of debt — credit card debt — then there is one more option to consider: Credit Card Refinancing.

Credit card refinancing and debt consolidation can often be confused for one another, but there are some key differences. This type of debt relief traditionally refers to when you transfer credit card debt to another credit card. It’s similar to debt consolidation, but instead of taking out a loan, your debt is moved to a credit card with a lower interest rate.

Let's take a look at a couple of pros and cons of credit card refinancing.

1) Interest Rates: These programs can have some of the best interest rates.

2) Choice Flexibility: Banks generally compete for your business, so you could potentially negotiate for the best interest rate.

1) Banks offer credit card refinancing because there is a belief that you will not pay off the entire balance. When this happens, the bank will incur future interest from you. If you aren’t able to keep up with payments, then you will end up owing more than you started out with.

2) Similar to debt consolidation, you may be tempted to continue adding more debt to your card. Be sure to either cancel your card once the debt is moved or be diligent about not adding more debt.

Everyone’s situation is different. And everyone has different forms of debt. But be assured that there are options to help you get out from underneath that pile of debt — even if it feels overwhelming! Ascend is dedicated to helping individuals take control of their financial situation with the goal of reaching and maintaining stability. We offer free counseling, so give us a call if you’d like to talk through your options.