TurboDebt's reviews are nearly perfect. Let's look at what we found when we took a closer look at the reviews themselves.

The purpose of this article is to cover TurboDebt reviews, understanding one of the most important elements of TurboDebt (cost), and help you understand if what is being promised is reality. Also, it appears that Turbo Debt may also be going under the name Debt Solutions America.

Let's begin. You may have seen ads on TikTok or Snapchat about TurboDebt. Let's look at an example. In the TikTok ad below, the individual talks about how you can get out of debt without taking a huge hit on your credit and not having to pay back the debt.

Two things struck me about this TurboDebt ad that I wanted to share right away. Firstly, the individual states the following:

Sounds great, right?

Now, if you are struggling with debt and wondering what to do next, we built a free, unbiased debt options comparison calculator (not even an email address is required) that provides a wide range of debt options that may be able to fit your budget. The data is personalized to your income and expenses, so you can get accurate costs, pros and cons, and options. Debt settlement may be a great option for you, but it's helpful to understand each of your options.

For those of you who may not be aware of this, TurboDebt is pitching something called debt settlement (also known as debt relief and debt consolidation programs). I was the previous CEO of a debt settlement company, and I know that debt settlement can negatively affect your credit. And, in debt settlement, you have to pay back some of the debt.

From my understanding, based on TurboDebt's Google My Business, Turbo does not actually settle debt, but is the exclusive partner of National Debt Relief. For this, it's definitely important to understand who National Debt Relief is, so we wrote an article covering National Debt Relief.

Recently, I put together a video covering 8 red flags when considering a debt settlement company. Hopefully, this video will be helpful for in your research.

You may be wondering what is TurboDebt and how does it work. One of the biggest questions I had is whether TurboDebt is a new company.

For example, as someone who has been in the debt settlement industry, I was surprised that I had never heard of a debt settlement company that had 2000+ 5 star reviews. I mean, National Debt Relief is one of the largest and has 3500 Google reviews but has been around for almost 13 years.

So, I researched TurboDebt on Wayback machine, and found that the earliest site crawl with information was on August 5, 2020. That’s less than two years ago. TurboDebt’s Facebook page is slightly older with a creation date of March 24, 2020.

So, TurboDebt appears to be a relatively new organization. Based on this study, there's a really interesting debt relief review distribution story where TurboDebt got over 400 Google reviews in one month while National Debt Relief's biggest month was just over 150 Google Reviews. And just for context, National Debt Relief is one of the largest debt settlement companies in the US. See the picture below.

Cost is an essential piece of debt settlement, so let's compare who TurboDebt refers you to against other debt settlement players in this space.

At Ascend, we believe that debt settlement may be a good option, but it’s only in the context of understanding all of your options and understanding the cost of that option. This is exactly why we built a free debt relief cost comparison calculator so that you are MOST informed.

So, what is the cost of TurboDebt?

If TurboDebt refers its leads to other debt relief providers, we can look at the other debt relief provider’s fees to understand the true cost. I’m going to share why I don’t like how fees are stated shortly.

National Debt Relief is a bit more forthcoming with this information at the bottom of its home page, “Clients who are able to stay with the program and get all their debt settled realize approximate savings of 46% before fees, or 25% including our fees, over 24 to 48 months.” Doing a little math, you can see that they are estimating 21% of fees.

Now, 15-25% is a huge range, and I would expect that most people will see fees between 21-25% for these companies.

These fees are quite high compared to the small handful of companies that we refer folks to that are in the 15-17% range.

Just for reference, a lower fee can save you THOUSANDS of dollars and get you out of debt faster.

This story gets more interesting, so let’s see whether we can find TurboDebt’s BBB page. A common question may be, is TurboDebt BBB accredited? Let's consider that next.

Unfortunately, after much review, I could not find a BBB page associated with TurboDebt.

The first thing I like to research is whether a debt settlement company has a BBB page. I believe the accreditation fee for BBB is about $530, so it’s not insignificant, but many debt settlement companies like to show their BBB rating upfront.

The only BBB page I could find is another business that is a Debt Collection Agency, called TurboDebt Recovery LLC, which is not the same thing.

So, let’s go through the reviews as this is where it gets more interesting.

The first thing that is interesting is that when you Google, “TurboDebt reviews”, you may only see the debt collection agency above.

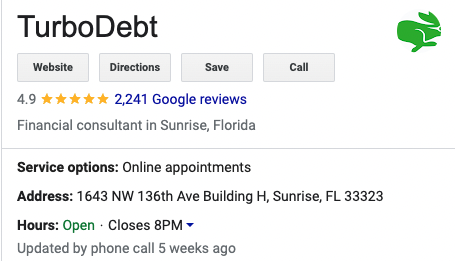

To find the reviews, you may actually have to do more digging. At the time of this writing, TurboDebt has a 4.9 rating based on 2242 Google reviews, 3.9 rating on TrustPilot, and a 4.7 rating on Facebook.

One of the most interesting things I've noticed since I first published this article is that TurboDebt has actually lost a Google review from April 7th, 2022 when I pulled the image below to the updated image pulled in August 2022.

Now, check out this image below that shows the number of Google reviews for TurboDebt in August, 2022 (4 months later). You can see that TurboDebt lost a Google review, which is very surprising considering previously, TurboDebt got over 400 reviews in one month.

How does a company go from having 2242 Google reviews in April 2022, but actually has 1 less review 4 months later?

My hypothesis is that TurboDebt requests individuals to review them shortly after giving the individual the peace of mind that their debt will be handled, and then TurboDebt decided to funnel those individual to Trustpilot which now has 1716 reviews at the time by the time of this update in August, 2022.

Now, let's take a closer look at the reviews themselves.

Let’s take a closer look at the Google reviews.

The first thing I recommend doing with Google reviews is to sort by 1 star descending to see the most negative reviews.

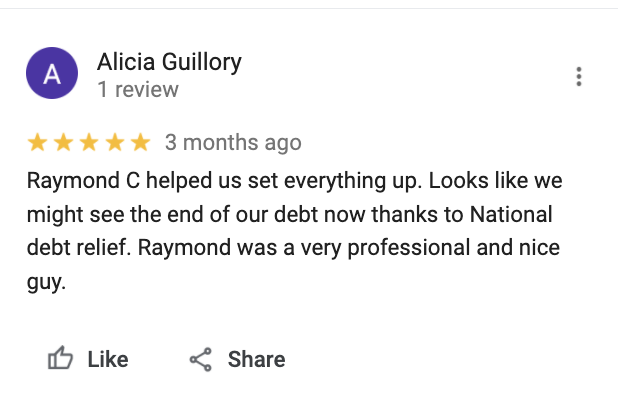

There’s a review where Alicia is thanking Raymond to help set everything up with National Debt Relief.

National Debt Relief is one of the biggest debt relief companies in the United States. And while it does settle debt, many people have had negative experiences. Check out how common this search term is, “National Debt Relief Screwed Me” based on Google’s Keywords Planner (which shows the estimated search volume per month). The link above is to the article where we cover that in detail.

Basically, the image shows that there’s been a 140% year-over-year growth in people searching for that term.

My hypothesis is that TurboDebt requests reviews before or RIGHT after you enroll in the debt relief program that they recommend.

Many people feel a weight lifted off their shoulders when they enroll in a debt relief program.

That said, that mood may change when their credit score falls or they face a debt collection lawsuit.

Personally, I am not sure whether I would use TurboDebt for the following reasons:

While National Debt Relief are major players who do settle debt, I generally look for companies that have amazing reviews and the lowest costs.

Let’s now cover alternatives to TurboDebt.

Let’s cover a few alternatives to TurboDebt and debt settlement. The information is general, but if you want to see personalized cost and duration for your situation, you can find that using our debt options comparison calculator.

If you want to do a debt settlement, you can consider finding a lower-cost debt settlement option that will save you money and get you out of debt faster. You can estimate the cost using our calculator above, and you can reach out to us if you’d like more information about our favorite options.

If you are already enrolled with a debt settlement company, you can consider doing consolidation of settlements. Basically, you may have realized that the fees are high and you can consolidate them into another debt settlement company to save money.

It’s a similar concept to a debt consolidation loan where you are consolidating higher-cost debt into a lower-cost debt solution to save money.

Debt management is also known as credit counseling. In a debt management program (DMP), the company would negotiate the interest rates on your high-interest credit card debt.

Debt management companies are often non-profit organizations that charge a monthly fee between $30-$50. Your credit score may not be as negatively affected as debt settlement, and plans are generally 3 or 5 years.

With that said, you may not save as much money with debt management vs debt settlement.

Bankruptcy is often many individual’s last resort, and for good reason. A Chapter 7 bankruptcy is on your credit report for 10 years, and a Chapter 13 bankruptcy is on your credit report for 7 years. Chapter 7 bankruptcy provides debt relief for around 120 days and Chapter 13 bankruptcy often lasts 3-5 years.

That said, Chapter 7 bankruptcy is often the cheapest debt relief option and the quickest. You often have to qualify for Chapter 7, which you can estimate using a Chapter 7 calculator.

TurboDebt is a company that refers their leads to another debt relief company. TurboDebt’s reviews show that it may refer its leads to such debt settlement companies as National Debt Relief. So, in order to get an actual perspective, you may want to research the company that TurboDebt refers you to to get the best sense of your experience with debt settlement.

With any debt settlement, it’s important to consider the pros and cons. You should also consider researching the Consumer Finance Protection Bureau's guidance on debt settlement and lawsuits against debt settlement company providers.