Many of you may know that CFPB sued Freedom Debt Relief for misleading consumers about its debt settlement services. The CFPB alleged that Freedom was making customers negotiate hi/her settlements and misleading consumers about the fees of its services. CFPB also alleged that Freedom Debt Relief failed to tell them about the rights of their funds deposited. Finally, it stated that Freedom charged consumers without settling their debts.

While the case was later settled for $25M, Freedom Debt Relief neither admitted nor denied, “... any allegations in the First Amended Complaint, except as specifically stated in this Order” with the order stipulating the rules of the judgment.

In our research, we found 2 Freedom Debt Relief lawsuits.

So, Freedom Debt Relief neither admitted nor denied the allegations, so does the company lie? Is Freedom Debt Relief a scam?

Not necessarily. While I cannot say whether a specific sales representative lied to you, Freedom Debt Relief has to abide by the CFPB’s orders to help protect you. You can also know that many individuals have had a good experience with Freedom Debt relief. The company has an A rating on BBB, and a 4.4 based on over 3000 reviews on Consumer Affairs, but that doesn't mean all of Freedom Debt Relief reviews are glowing. For example, Freedom has a 1.5 rating based on 31 reviews on Yelp, and you can't even find Freedom Debt Relief Google reviews, which I find curious as I find both of those review sites tend to be unbiased. The only thing I found was Freedom Financial Network's Google profile, but no reviews associated with it.

We will go over this in much fuller detail below, but here's an analysis of almost 50 Freedom Debt Relief reviews on Consumer Affairs.

That said, one of the important things with Freedom Debt Relief (or any debt relief company) is to pay close attention to the Client Services Agreement.

Thankfully, Freedom Debt Relief shares a copy of its client services agreement online. So, if you are speaking with a sales representative, you can easily compare that to what you read through in the client services agreement.

Below is a picture of our client services agreement when we used to practice debt settlement. Just for reference, we now help people compare options such as debt settlement vs Chapter 7 vs Chapter 13 bankruptcy. Ascend's goal now is to help you get out of debt cheaper, easier and faster when facing financial hardship.

Let's now talk about the fees.

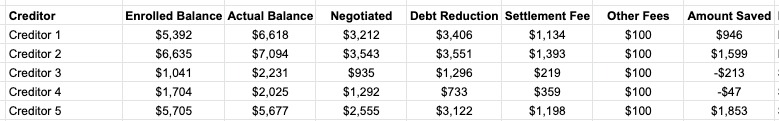

Many debt settlement companies charge a % of enrolled debt ranging from 15-25%. Let’s take a look at an example if Freedom Debt Relief charges you 25% of your enrolled debt.

This savings can be much less than you would have expected when you started the program. Now, there are companies that charge much less in fees, which is how you can really save money. We work with 2 reputable companies that charge much fewer fees, so you could save significantly more.

What I would recommend is to use our tool to compare the cost of debt settlement and other options.

I had a conversation with a bankruptcy attorney recently. In the conversation, he stated that debt relief companies help him get a lot of clients.

Why?

Because many debt relief companies do not look at your lawsuit likelihood. I am not sure whether Freedom Debt Relief does this, but it's an important question to ask them. For example, American Express and Discover often sue for unpaid debt, but did you know that before signing up?

Before building debt relief calculators to help people compare options in an unbiased way, we used to be a debt settlement company, so we comprised the data for those creditors who are likely to sue and built a lawsuit likelihood calculator, so you could add your creditors in and have an estimate of whether you would be likely to be sued.

You may wonder if you should avoid debt settlement if you have a creditor that is likely to sue you.

Not necessarily.

If you have only 1 creditor out of 8 that are likely to sue, then the debt settlement company can prioritize settling that debt before others. Also, when a creditor sues, a debt settlement company like Freedom Debt Relief may be able to settle the debt, but just for a higher percentage. So, you may have gotten 50% of the balance owed before, and now have to pay 75% of the balance owed.

That said, if most of your creditors are likely to sue, then you may pay well over 100% of the balance owed after accounting for debt settlement fees, so then an individual may consider looking at Chapter 7 qualification using the means test or Chapter 13 bankruptcy.

Many people are comparing different debt settlement companies based on two primary factors, and Freedom Debt Relief is no different:

As such, you may be comparing one debt settlement company’s offer of $500 for 60 months to another offer of $600 for 48 months.

These estimates are often based on what the debt settlement company can negotiate the debt for. Creditors may change the percentages that they offer for settlements. So, that can increase the amount of what your monthly draft will be to acquire settlement.

Also, if the debt settlement company is not good at accurately predicting lawsuits, that can be another issue.

As such, some people do feel that they should have known about potential increases in monthly drafts. This is definitely something to consider when joining a debt settlement program.

Freedom Debt Relief has helped thousands of people get out of debt and achieve debt freedom. So, should you work with Freedom Debt Relief or another debt settlement company?

That is ultimately your decision, and you understand your situation best. Here are a few resources that can help you make the most informed decision:

Making a broad statement that Freedom Debt Relief lies is not something I would be willing to make. For example, it does not give Freedom Debt Relief the benefit of the doubt.

Are there times when consumers feel misled? Look at the reviews and other sources on your own to make the most informed decision for your situation. Our goal at Ascend is to help you get out of debt cheaper, easier and faster. If there’s any way that we can help you accomplish that, please give us a call at 833-272-3631 or take one of our free debt comparison calculators.