"I became a bankruptcy attorney to do marketing," said no bankruptcy attorney ever. Like many of our bankruptcy attorney partners, you went to law school to practice law, not to figure out how to get bankruptcy leads. Thankfully, Ascend specializes in bankruptcy leads, so hopefully this article will help you get free bankruptcy leads if you are a solo practice or if you have bankruptcy attorneys in your staff.

Let's cover 8 different ways that you can get bankruptcy leads today.

In my opinion, the best bankruptcy leads are those who:

We have purchased numerous leads in the past that may need to file, but have absolutely no funds available to file. You may also run into bankruptcy leads that are judgment proof due to having only social security income. Now let's cover the different bankruptcy lead options.

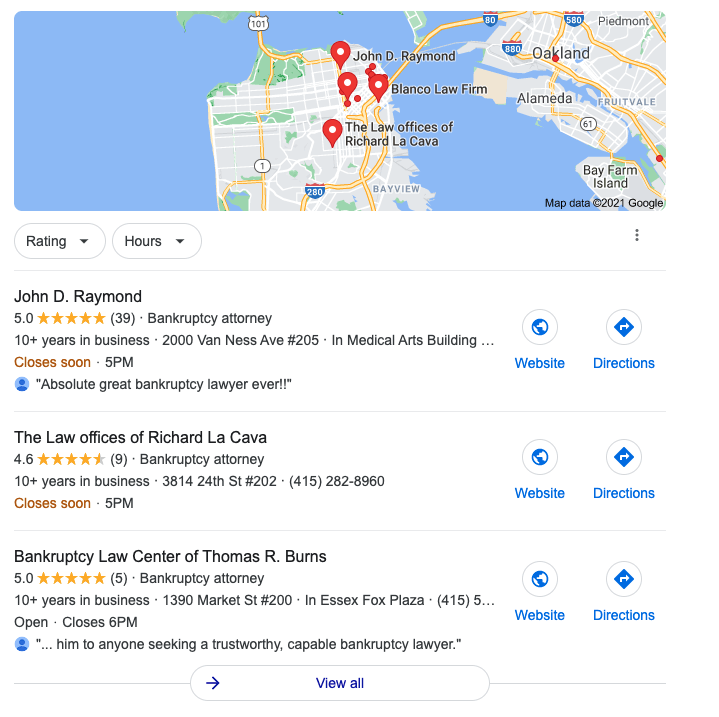

You can get many bankruptcy attorneys leads by getting on the Google Local 3-Pack for Google My Business. In short, the Google local business 3-pack is the first 3 businesses when doing a search for a specific business. Many consider this the holy grail of SEO, but it is quite challenging to obtain.

You may need to get many bankruptcy attorney reviews to get into the top 3 positions. You may consider bankruptcy software for attorneys reviews.

In addition, we wrote an entire guide to help bankruptcy attorneys get free bankruptcy attorney leads from the Google 3-Pack.

Let's look at an example. See the Google local business 3-pack for "bankruptcy attorney San Francisco".

At Ascend, we are researching whether it makes sense to help bankruptcy attorneys manage their Google maps ranking. Regardless, I'd like to explain how to rank on the Google Maps Local 3-Pack in case you'd like to do it on your own. To start, you would set up a Google My Business account, which I definitely recommend. You can have people provide reviews on this website.

So, how do you rank in the Google Local Business 3-Pack to get bankruptcy attorney leads? Our hypothesis is that it's a combination of the following:

Search Engine Optimization (SEO) is the skill of optimizing your website to be helpful to readers. The goal of SEO is to provide helpful, contextual content to the reader. In return, Google will award you with a higher ranking. Google may use things like page speed load, on-time reading, and how the user interacts with your page to help distinguish whether to give you a coveted top 5 search spot. Another important thing that Google uses to determine how to rank websites is whether that website got links referencing to the site from other sources.

Now, you must realize that Google separates paid ads from SEO. With paid ads, you are able to move up the rankings potentially with less quality content (even though quality matters).

Let's illustrate that point. See the image below for the search term, "Chapter 13 calculator". This search showed 3 ads and then 1 organic search. You will notice that the ads will always have "Ad" next to the title.

To learn more about general SEO, I like AHREF's beginner SEO guide on the subject. Moz and Hubspot also tend to have good guides for general SEO.

You may not get many bankruptcy leads from word of mouth referrals from customer to customer because many people don't talk to friends and family about debt issues. That said, you may receive bankruptcy leads from other attorneys that do not practice bankruptcy law.

For example, a family attorney helping a couple through a divorce may need a bankruptcy attorney to refer people to. You could set up a relationship where you would send family-related legal matters in exchange for bankruptcy leads.

There's a variety of ways that you can do this, and some may also opt for some sort of paid arrangement in accordance with 11 U.S. Code § 504 - Sharing of compensation.

A recent bankruptcy attorney in Tennessee asked us, "Why don't you white-label your bankruptcy calculators and allow me to embed the calculator on my website?"

Many bankruptcy attorneys have visitors to their page, but those visitors don't actually turn into webform submissions (i.e. bankruptcy leads). As such, we realized that our bankruptcy calculators can actually be hugely beneficial to turn these low-performing pages into high-performing bankruptcy leads pages.

So, we have already built the bankruptcy calculators, but this is what we are considering for those of you who would want to embed the bankruptcy calculator on your website:

1) No upfront costs

2) No monthly retainer

3) No need for engineering resources

4) Ascend would do the work to add the calculator to the appropriate pages

5) 10 free bankruptcy leads. After that, it would be just $9.99 per lead.

The main requirement we would have to have is that your website has some visitor traffic. If you are interested, please join the waitlist here as we generally will only build products that attorneys want.

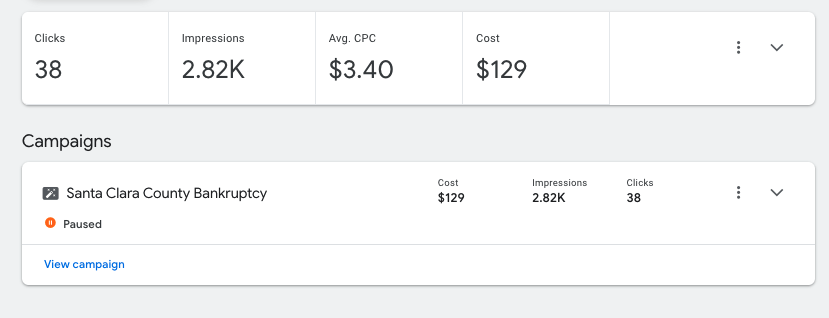

Many attorneys and bankruptcy lead services use Google (and sometimes Bing) to get bankruptcy attorney leads. The reason is partial that you can get search intent. For example, someone searching for "file bankruptcy now" or "bankruptcy attorney near me" may have a high intent to file bankruptcy. We have had more success with Google than Bing over the years, but we still run Bing ads.

Unfortunately, Google ads are difficult to navigate for a couple of reasons:

The Google Ads system is very complex. I worked at Google from 2012 to 2015, so I have many years of experience with the system. That said, I cannot imagine working in Google ads for the first time.

Secondly, when you sign up for Google ads, you are placed on a simpler version. It's probably to make sure you succeed (and don't become too overwhelmed), but I have found that it's so simple that it actually is hard to succeed. Take a look at this test I ran below on the simpler version

How does $50 PER CLICK sound? That's not per bankruptcy lead or per client. That is per click.

Google prices the terms based on an auction system, so you are competing against other bankruptcy attorneys or lead services or debt settlement companies. Thus, your cost per click for "file bankruptcy now" could be very high, making those terms cost-prohibitive.

How much you spend to obtain a customer is called your "cost of acquiring a customer" or CAC. In my opinion, your CAC should always be below 50%, so if you charge $1,500 in fees for a Chapter 7, you should not spend more than $750 to acquire the customer. That said, I believe a good target is 33-35% though.

We have not seen the success getting bankruptcy attorney leads in Facebook / Instagram ads that we have seen in Google and Bing Ads. Why? I believe it's mainly based on users' intent.

With Facebook, you have a better opportunity to segment your audience, but it's difficult to know who is searching for bankruptcy and who is not.

With Google and Bing, you have the intent of the user's search which is in relation to bankruptcy. Unfortunately, you are not able to specify your audience like Facebook.

That said, I believe it is possible with the right tools to get bankruptcy leads through Facebook. It's something we will continue to test in the coming months and years.

Bankruptcy lead services are another avenue that people use to get access to bankruptcy leads. These firms specialize in marketing to obtain folks who are interested in bankruptcy. There are numerous firms that provide bankruptcy leads, so if you go this route, you may want to run tests to see how these leads perform for you. The bigger bankruptcy lead services may be 4Legalleads, NOLO, or Lawyer Marketing.

We are Ascend are a growing player in the bankruptcy lead space, and have grown from 2 bankruptcy attorney partners to 125+ partners in 2023. Unfortunately, we have very little availability in the US as we do send exclusive leads, but please learn more about our offering here and reach out,

There are 4 things to look out for when using a bankruptcy lead service:

You may think that this is a given, but some bankruptcy lead services sell the same lead to multiple firms. The cost per lead is generally lower, but that means that you are in competition from the start to get a hold of the individual quickly. This should also reduce your conversion rate. I am not sure how the potential client feels getting calls, texts, and emails from multiple bankruptcy firms.

Understanding pricing is important. How many tiers of pricing do they have? I have always been somewhat suspicious of the firms that only do price per lead. Generally, if you have great leads, you want to do price per qualified lead (only get paid when an individual becomes a client. If you have poor to great leads, you may want the price per lead because the conversion rate may be low This is not always the case, but I appreciate when bankruptcy lead services provided different tiers of pricing.

In all bankruptcy lead services, you will have wrong numbers and bad numbers. Ascend runs an API verification of phone and email, but there are still bad ones sometimes. Often you will have to pay for leads you don't get a hold of. That said, you should confirm that you can dispute bad leads.

You may think that the bankruptcy lead service gets leads through a bankruptcy site sharing information about bankruptcy. That's not always the case. I have heard horror stories from bankruptcy attorneys who said they got "bankruptcy leads" from people that had no interest in filing bankruptcy.

You will see personal injury attorneys advertise on billboards/buses/signs for personal injury leads, but I have not seen it as often for bankruptcy attorney leads.

One bankruptcy attorney partner mentioned that he saw them in Orlando, but personal injury leads may produce more revenue. Also, personal injury attorneys are targeting people who have gotten in a car accident, so it's likely that those individuals may still be driving on the streets.

You may have gotten an email about becoming a sponsored source on a legal search website. These can includes Avvo specifically for legal services and potentially something like Thumbtack that is broader, but provides bankruptcy attorneys as an option.

These sites may charge you a monthly retainer or a pay per lead basis. The key for these sites if you pay a monthly retainer is how much foot traffic will these pages get in a month. For example, I spoke with one attorney recently that paid around $700-$800 per month to be a sponsored attorney, and he didn't know exactly how many leads he got from that site.

For example, this means he could have paid almost $10,000 per year in fees, and may have not ever gotten any leads from the site if there's no one visiting the page. Here's an example below (source) for Memphis, Tennessee.

Even in 2021 with bankruptcy filings down nearly 60% from 2 years ago, people are still looking and filing bankruptcy. I am not seeing the bankruptcy filing explosion even in early 2022. You understand bankruptcy law, and hopefully, now you have some insights on how to get bankruptcy leads effectively from free options to paid options.

Also, many attorneys have been burnt by bankruptcy lead providers, which is why we offer 100% no risk trials where the 10 lead test is free if you do not get a certain threshold in attorney fees. We have grown from 2 attorney partners in 2019 to over 120 partners in 2022 with very low attrition. If you are interested, please fill out the form below.