Did National Debt Relief tell you that “the fees are included in the plan”, but didn’t explain the exact percentage you would pay?

Did National Debt Relief say that you could get sued, but they have a “legal” plan that can help if you do get sued? Did they mention how expensive that legal plan actually is in your 36-60 month plan?

If so, this article is for you.

In this article, we will provide you an inside view of the cost you may be paying in simple terms your lawsuit likelihood, and much more to understand whether debt relief is a good option for you.

Did you know that “National Debt Relief Screwed Me” is a growing search term on Google (source)? Yes, according to Google, there has been a 140% year-over-year change for that specific term.

Why?

Many people sign up for a debt relief company potentially knowing the pros of debt relief, but maybe not realizing all of the cons of debt relief.

The purpose of this article is to share what debt relief is and your options if you’ve felt wronged by a debt relief firm.

What Is National Debt Relief?

Debt relief is an option that people consider when they face financial hardship. A debt relief company or the individual themselves realize that they are unable to continue making payments on their debt. Thus, you may realize that the accounts are going behind soon. The most common debt relief options are debt settlement (which individuals use interchangeably for debt relief), Chapter 7 bankruptcy, Chapter 13 bankruptcy, and debt management (also known as credit counseling).

National Debt Relief is a debt settlement company. A debt settlement company would attempt to negotiate the total balance due on accounts that are behind. For example, debt settlement is different from debt management as the company negotiates the balance lower in debt settlement and the interest rate lower in debt management.

How Much Does National Debt Relief Cost?

One of the most important things to consider is how much the National Debt Relief program costs. It may be difficult to understand the cost even after speaking with the representative, but you can expect that the cost will be between 15 – 25% of enrolled debt, but you may often see over 20% of charges. That is a huge variance, so we built the calculator below to help you estimate your all-in monthly cost of debt relief (including fees) and compare it to what you are currently paying. The calculator also allows you to compare the cost of such alternatives as debt management and debt payoff planning.

National Debt Relief Screwed Me Meaning

While we don’t know why the search term, “National Debt Relief Screwed Me” is so popular, let’s discuss some things to know about debt relief programs.

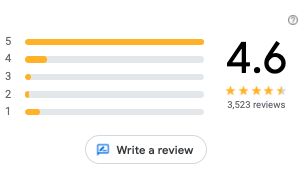

You may have joined National Debt Relief and felt relief and burden lifted from your back. You did your research and found that National Debt Relief has an A+ BBB rating and a 4.6 rating on Google reviews based on over 3500 reviews. But, your experience was anything but A+. For example, you may have calculated the fees on a settlement and found out that you are paying more in fees than if you would have paid 100% back to the creditors before enrolling in the program.

We realized that many individuals may want to cancel their National Debt Relief contract, so we wrote this guide “How to Cancel National Debt Relief Contract“.

Here’s what we will cover in this article.

- Fees: I didn’t know that the fees were ~25% of the enrolled debt.

- Lawsuit: I didn’t know I could be sued. I got sued.

- Credit Score: My credit score was impacted far longer than I expected

- Increased Monthly Draft: I was asked to start paying more per month than originally stated

- Is National Debt Relief Legitimate?

- National Debt Relief Pros and Cons

Your experience may be something completely different, but in any case, you feel that you were screwed. To help people in the future, we actually created a video: 7 Urgent Questions to Ask National Debt Today.

That said, what are your options now that you may have a debt collection lawsuit you are facing or are facing another issue.

1. National Debt Relief Fees: I was not sure what I would be paying when I enrolled.

One of the most common concerns that I have seen is the National Debt Relief fees (link to in-depth article) which can be around 25% of the enrolled debt.

Let’s look at the following scenario:

- Enrolled Debt: $100,000

- Settlement Fees: $25,000

- Settlement: $60,000

- Tax Liability from Forgiven Debt: $10,000 (25%*$40,000)

- Actual Savings: $5,000

Now, this is not always the case as you can be deemed tax insolvent, but a $5,000 savings seems to be a lot less than what you signed up for.

How much am I actually paying in fees?

When we used to be a debt settlement company, we would list the debt settlement fees in the Client Services Agreement. So, you should be able to look at the National Debt Relief client services agreement and see the actual fees that you are paying.

What are my options now?

You have options, and we have helped many people in this exact situation. So, let’s cover your options one by one.

Option 1: Debt Settlement Consolidation:

One of the most common options may be to consolidate your debt settlement into another debt settlement consolidation program. So, in the above example, the individual was paying $25,000 in fees.

There are a handful of reputable companies that charge 15% instead of 25% in fees. In this situation, you could consolidate your debt with another debt settlement company and save almost $10,000 in fees. You would see the benefit in one of two ways:

- Lower monthly payment and/or

- Shorter plan duration.

Because we saw this so often, we built a free debt settlement consolidation calculator that you can estimate how much you would save in your monthly payment and/or shorter plan duration. Here are some common questions about debt settlement consolidation.

What about my accounts that are currently in a settlement?

One of the most common questions we hear when someone does a debt settlement consolidation is, “what if I am currently paying in a debt settlement?” Many people are considering debt settlement consolidation started the program after a National Debt Relief has settled an account.

In this case, you may do a few things:

- Reduce your monthly draft amount to the amount of the payment and any fees. Make sure to include the escrow account fees.

- See whether the creditor will work with you or the new debt settlement company for the remainder of the settlement.

- You can break the settlement, but that may not be advisable as the amount paid will potentially just be paid to the principal owed, and you’d have to settle again. For example, if you settled a $10,000 account for $5,000. If you paid $2,500 toward the settlement and it broke, you may owe $7,500. If a debt company settled the debt for 50%, you would owe $3,750 thus losing at least $1,250 not including the new debt settlement company fees.

How Do I Cancel A Debt Relief Program?

The client services agreement should also show the steps you need to take to cancel a debt relief program. For example, when we were a debt settlement company, here’s the client services agreement portion near the end of the agreement that show your cancellation rights.

Now that we covered debt settlement consolidation, let’s cover bankruptcy qualification.

Option 2. Do You Qualify for Chapter 7 Bankruptcy?

Many individuals choose debt relief because they want to avoid bankruptcy. National Debt Relief’s program is a common alternative to bankruptcy.

That said, Chapter 7 bankruptcy is often much cheaper and faster than a debt relief program. There are pros and cons of bankruptcy that you should consider such as that Chapter 7 bankruptcy is on your credit report for 10 years and that there are often time limits when you can purchase a home.

Although Chapter 7 bankruptcy is often the cheapest and fastest option, you also have to qualify for Chapter 7 bankruptcy. We got the question, “Do I qualify for Chapter 7 bankruptcy?” so often, so we built a free Chapter 7 bankruptcy calculator that is updated with the most recent means testing data to help you estimate Chapter 7 bankruptcy qualification.

Option 3. Settle the Debt Yourself (Without a Program)

Another option you can consider is settling the debt on your own without using a debt relief program. Let’s cover the pros and cons of settling debt by yourself.

Pros:

- You save on the fees which can be ~25% of enrolled debt for National Debt Relief. This pro is significant because that can be a significant amount of money.

Cons:

- A debt settlement company should know which creditors settle for what amount

- A debt settlement company should know which creditors sue and which creditors do not sue

- Debt negotiation can be intimidating working with many debt collectors at the same time.

- You have to save the money on your own instead of having a special purpose escrow account

- You provide the power of attorney to the debt settlement company, so they become the middle man between you and the debt collectors.

- Payment operations can be complex with sending checks to multiple creditors at once.

A good rule of thumb may be that if you have just one account that is a high balance then it may make sense to settle the debt on your own if you are comfortable with the process.

Finally, if you’d like to know how to settle your debt, check out our video covering how to settle your debt with debt collection agencies to answer your questions.

2. Sued While In National Debt Relief Program

One of the biggest risks of debt settlement is being sued for your debt. National Debt Relief may still be able to settle those debts. As such, some people consider Chapter 13 bankruptcy if they do not qualify for Chapter 7 or have assets they would lose for the bankruptcy protection from debt-collection lawsuits.

You still have options when you have been sued while in a debt relief program. Let’s cover those options now.

Option 1. Ask National Debt Relief to prioritize the lawsuit

In this case, you could ask National Debt Relief to prioritize the debt and settle that one before other debts. National Debt Relief may already be trying to aggregate funds to settle that account.

In this case, you may have to settle this account for higher than what was originally anticipated. For example, the creditor may settle for 75% of enrolled debt instead of 50% before the lawsuit.

That said, you should also consider the lawsuit likelihood of your other creditors. For example, let’s say National Debt Relief settles this lawsuit, but what if you get sued by 3-4 other creditors.

Then, you may be in a position where you pay more settling the debt than paying 100% back to the creditors.

Option 2. Check Your Lawsuit Likelihood on Other Accounts

Because we see this issue so often, we built a free lawsuit likelihood calculator based on our past knowledge of settling debt with creditors, so you could estimate which creditors you owe that are likely to sue and which creditors are not likely to sue.

If you realize that most of your creditors may sue you, you may consider looking at our free debt settlement consolidation options calculator above that provides the cost of other options, in addition, to allowing you to compare debt relief to Chapter 7 bankruptcy, Chapter 13 bankruptcy, debt management, and debt payoff planning.

Option 3. Answering the Debt Collection Lawsuit

You may want to answer the debt collection lawsuit directly. A debt defense attorney can help you draft the response if you’d like to go this route. There also may be free or paid options available that can help you draft your response directly.

If you decide to answer the debt collection lawsuit, consider understanding how long you have to respond and which court you need to file the response to.

Option 4. Do Nothing (You would probably have a judgment against you)

The plaintiff will likely file a “request for default” which means that you no longer have the ability to defend yourself by responding to the lawsuit. At this point, you may not be able to disagree with the amount you owe. The plaintiff may next ask the court to enter a default judgment against you.

If you have a default judgment against you, the plaintiff may try to enforce the judgment through a garnishment, levy, or lien. You could also see the judgment on your credit report.

You can check how the creditor may enforce the judgment against you based on your state’s guidelines.

3. Credit Score Impact While In National Debt Relief Program

Many people ask the question, “how will my credit score be impacted by National Debt Relief’s program?

While most individuals know that their credit score will go down, many people may not be aware of how long the credit score will be down and when they will be able to purchase a home after the program.

As such, someone may say you should do credit repair, but please consider reading CFPB’s information on credit repair. There are many companies that charge a lot of money but may not do a lot of beneficial things for your credit.

If this is the case, you could look at debt settlement consolidation to help get you out of debt faster or look at a debt settlement alternative.

4. National Debt Relief’s Monthly Draft Increase

National Debt Relief may have asked you to pay $300 per month then later asked to start paying $400 per month due to the settlement amounts being higher than what was originally intended.

In these cases, if you do not have the funds available per month to increase the price, you could look at debt settlement consolidation per the information provided above.

You could also ask whether you could extend the program and pay the same rate or ask what would happen if you do not increase the monthly payment.

Is National Debt Relief Legitimate?

You may have had a bad experience and wonder if National Debt Relief is a legitimate company.

Yes, National Debt Relief is a legitimate debt relief firm even though you may have not had the best experience working with them. For example, National Debt relief has 4.6 rating on Google with the majority being 5-star reviews.

National Debt relief also has an A+ BBB rating with a 4.37 rating based on over 1000 reviews.

So, while you may not have had a great experience thus far, National Debt Relief is a legitimate company.

Should You Sign Up For Another Debt Relief Firm?

Understand all of your options.

Debt relief via debt settlement can be a helpful option, but it is not the ONLY option. You may want to holistically compare all of your options and the potential fees and companies that offer those options. We built the following free resource (does not even require email address) to help you understand all of your options, so you can compare those options to National Debt Relief.

- Compare reviews of other debt relief companies

- You can compare the all-in costs of other debt relief companies

- Compare costs and pros and cons of alternatives such as bankruptcy, debt management (credit counseling and debt payoff planning)

National Debt Relief Pros and Cons

Let’s start with the Pros of working with National Debt Relief.

Pros:

Debt settlement can be the first step on your path to a secure financial future. While there are some dangers to be aware of, there are also many benefits you can get from debt settlement. Here are just a few:

The Savings

It’s hard to get around the massive savings that debt settlement can give you. You can expect anywhere between 10-50% savings from your total debt amount after negotiations. Savings of this amount can be the difference between years or just months of debt payments.

Volume

As National Debt Relief is one of the largest players, you can count on its system to be well-built and reliable. You can find that they will have some functionality such as a dashboard to allow you to monitor your accounts. The sheer volume of clients they have has forced National Debt Relief to scale its services in an efficient way.

Timeline

Alternative options like bankruptcy and debt management can take years. Debt settlement, however, can take as little as a few months. With a faster debt relief process, you could begin your new financial future even sooner.

Avoid Bankruptcy

Going through debt settlement can help you avoid the need for filing for bankruptcy. While debt settlement has its own negative consequences, bankruptcy’s consequences can be more taxing and far-reaching. Settling your debt can ensure you avoid the consequences of bankruptcy.

Financial Accountability

Most debt settlement companies require that you close your credit card accounts once you begin the process. Because of this, there is higher financial accountability that can help you keep from obtaining even more debt.

Cons:

It’s true that there are significant benefits that are potentially available through debt settlement. However, you also need to consider some of the dangers you may not know about. Here are just a few:

The Fees

Unfortunately, these debt settlement companies do not work for free. Typically, you can expect to be charged anywhere from 15 to 25% of your total debt amount. It’s also important to note that National Debt Relief has a reputation for charging more, up to around 25% of your total debt.

Please Note: Your debt settlement company should NEVER charge you any fees for their services BEFORE your debt has been settled. If the company you are working with requests payment for their services before they have completed negotiations, understand that this is illegal and you may want to consider finding a different company to work with.

The Credit Score Impact

Like most debt relief programs, there will definitely be a blow to your credit report. There are two main things that will cause your credit score to go down. The first is the missed payments you will be required to ignore. As soon as the debt settlement process begins, you will be advised to miss payments in order to apply pressure on your creditor. This will eventually cause your account to become delinquent, which will be reported to the credit bureaus, meaning it will be on your credit report.

Not Actually Saving Money

Despite the fact that debt settlement is meant to allow you to pay less to become debt-free, the fees that are associated with your debt settlement company may cause you to end up paying more. Make sure to compare what you are likely to save with what you are likely to be charged before deciding if it is wise to enroll in a debt settlement program.

Lawsuit Likelihood

Creditors that you are trying to settle with do have the option to file a lawsuit against you. Once you default on your payments, if the creditor has the means and the time, they can take you to court where you will likely be ordered to pay back what you owe. Your debt settlement company should be able to help you figure out if your specific creditor is likely to sue you, but make sure you really consider the possibility before moving forward.

While the previously listed cons reference debt settlement in and of itself, it’s also important to realize that National Debt Relief does have its own set of cons to watch out for. If you have decided to go through debt settlement read through these warnings about National Debt Relief before gettings started.

Higher Fees

As mentioned earlier, National Debt Relief charges higher than normal percentages — up to 25%. That extra five percent can equate to thousands of dollars, depending on your situation.

Reputation

While National Debt Relief is legally more clean than other national debt settlement companies, there are plenty of anecdotal testimonies of people feeling as though they have been screwed by National Debt Relief. Stories of extra charges, rude customer service, or representatives that don’t do their jobs to the best of their abilities have circulated the internet, leaving others to question National Debt Relief’s integrity. If you are someone who doesn’t mind advocating for themselves and knows what they need to expect from a debt settlement company, then you should be okay. But make sure you consider whether or not you want to battle the company representing you along with battling your debt and creditors.

Should You Sign Up with National Debt Relief?

Ultimately, this is a decision you will need to make after considering the details of your personal circumstance. You can consider checking such pages as Reddit for other people’s experience of National Debt Relief or checking the company’s reviews.

Ask yourself what is best for your unique situation! Do the pros of debt settlement outweigh the potential cons? Are you willing to stand up for what you need from your debt settlement company? If so, then perhaps working with National Debt Relief will be beneficial. But if you think you need a company that has better customer service reviews or lower service rates, then perhaps keep looking around for a different company.

Whatever you decide to do, make sure it is the plan that will best suit you. And if you want to talk through what those options may be, consider giving us a call! At Ascend, we have dedicated financial counselors ready to speak with you about your options — best of all, it’s free! Give us a call and we can help walk you through what may be the best move for your situation.

Let’s Summarize

National Debt Relief has helped thousands of people get out of debt via its debt relief program as seen by its 4.6 rating on Good based on over 3500 reviews. When you check Reddit, you can find individual experiences, but your experience may have been one where you felt screwed.

That said, that’s not always everyone’s experience, and some people have had negative experiences potentially based on the fees, you were sued, your credit score was more negatively impacted, or you were asked to pay more than what you originally agreed to pay.

As the previous CEO of a debt settlement company, I would love to answer your questions. Please reach out to us directly at support@tryascend.com if you have any questions whatsoever. We are here to help you make the most informed decision.