You are looking for a bankruptcy attorney in Howard, Wisconsin and probably want to find the best attorney for the most reasonable price.

When filing bankruptcy in Howard, there here are 5 attributes that we look for in bankruptcy attorneys, which are 1) Rate 2) Reviews 3) Relevance 4) Reliability, and 5) Referral. We also care about bankruptcy attorneys who offer free consultations and payment plans.

See the table below for bankruptcy lawyers servicing Howard. If you'd like to understand the all-in bankruptcy cost in Howard, we built a free qualification and cost calculator below to estimate fees. Update the zip code if you’d like to refresh the list. Please note that the phone information below will first route to Ascend, and we will check our system for available attorneys who are available for a free phone consultation before transferring you to the attorney. If you'd like to speak directly to a specific attorney below, you should be able to find that information directly on the attorney's website.

| sort_num | guid | has_phone | Firm | Rating | Reviews | Relevancy | Free Consult | Payment Plans | Contact | Click to Call |

|---|

Fill out your information for the local attorney. Please note that the attorney selected may not be the one which contacts you.

Howard has a estimated population of 20177. What we found is that folks in bigger cities such as Milwaukee or Madison like to often have bankruptcy lawyers who are close by. In smaller towns with a population under 20,000, some individuals actually like to hire bankruptcy lawyers far away because of potential angst about other individuals finding out about the bankruptcy hiring.

This is why we built the zip code updater, so you can update the zip code to where you’d like to hire a bankruptcy attorney, which potentially might not be in Howard.

The bankruptcy attorney fee in Howard is often based on a number of factors. Here are some of the factors:

We had mentioned earlier the population of Howard is 20177. As such, larger cities may have higher attorney fees and smaller towns may have lower attorney fees. For example, Green Bay may have a lower bankruptcy lawyer fee than Milwaukee.

For example, Howard has a median household income of 70385. So, the income and general cost of living in Howard may dictate the attorney fees.

Secondly, the complexity of the case may dictate the cost of the bankruptcy. This is often the case with Chapter 7 bankruptcy. Do you own a home? Are you married? In Howard, approximately 55% are married. If you are married and filing with your spouse, you may have additional complexity to the case, potentially in a higher attorney cost. Secondly, are you a home owner? Approximately 65% of individuals in Howard own a home. With positive equity, you often check Wisconsin bankruptcy exemptions to determine whether you can keep the home. So, if your case in Howard is more complex, your attorney fee may be higher.

Okay, let’s dive into how the type of case may result in higher or lower bankruptcy lawyer fees in Howard.

Chapter 7 bankruptcy is the most common bankruptcy in the United States. Of the 10,427 bankruptcies filed in Wisconsin, my guess is the majority of those are Chapter 7 bankruptcies.

The Chapter 7 bankruptcy is often more simple. You can get a discharge (forgiveness) of debt in as little as 120 days. There’s often only one meeting and potentially less paperwork. Many people become nervous that they will lose belongings if filing Chapter 7 bankruptcy, but bankruptcy exemptions in Howard can help protect those assets.

As such the cost is often less. In Wisconsin, the estimated Chapter 7 bankruptcy attorney fee is $1100 - $2300. You can use our free Howard Chapter 7 qualification and cost calculator to estimate qualification and cost.

Chapter 13 bankruptcy is a payment plan bankruptcy, designed for those making regular income to pay back a part of their debts. The Chapter 13 bankruptcy is often 3 or 5 years, resulting in monthly payments in coordination with the Chapter 13 Trustee in Wisconsin.

As such, the Chapter 13 bankruptcy is quite a bit more complex, so the estimated Chapter 13 bankruptcy attorney fee range in Wisconsin is $4,500. The fee may be the same across Howard because of what’s called a no-look fee, which is a set rate for the reasonable fee for the service provided.

The Chapter 13 bankruptcy fee is often included in the Chapter 13 plan. Before you file Chapter 13 bankruptcy, you may also want to consider Chapter 13 trustee fees, which is an estimated 5.8% - 6.4%%. You can use our free Wisconsin Chapter 13 Howard Chapter 13 payment plan calculator to estimate your complete Chapter 13 plan payment, which includes the estimated bankruptcy attorney fees, the trustee fees, and the disposable income calculation.

Free bankruptcy consultations are designed to help you know whether bankruptcy is the best option for you. Because you are in financial hardship, many bankruptcy attorneys offer this service to alleviate the burden of another financial expense.

You can ask questions related to bankruptcy, and you can also get an estimate of what the bankruptcy lawyer fee will be in Howard. You can also get multiple opinions via free bankruptcy consultations if you didn’t jive with the attorney or you would like to discuss both types and qualification with another attorney.

Yes, many bankruptcy lawyers take a payment plan, and I would estimate that would be no different in Howard. A Chapter 13 bankruptcy is already a payment plan bankruptcy, so many Chapter 13 bankruptcy lawyers will take a payment upfront and then include the rest in the plan.

In a Chapter 7 bankruptcy, many lawyers will take payment plans, but the total attorney fee often has to be paid before filing. If an bankruptcy lawyer in Howard will only take all of the money upfront for a Chapter 7 bankruptcy and not provide payment plans, you may be able to find one that does take payment plans.

Just to confirm, you may always want to check which type of bankruptcy you are filing. Some bankruptcy lawyers may offer payments plans or $0 Chapter 13 options, but those may be much more expensive in the long run than doing a payment plan upfront on a Chapter 7 bankruptcy.

One of the most important attributes we look for in a bankruptcy lawyer in Howard is whether they are reliable. The reason for this is that there are certain deadlines that have to take place, and you need someone who will meet those deadlines.

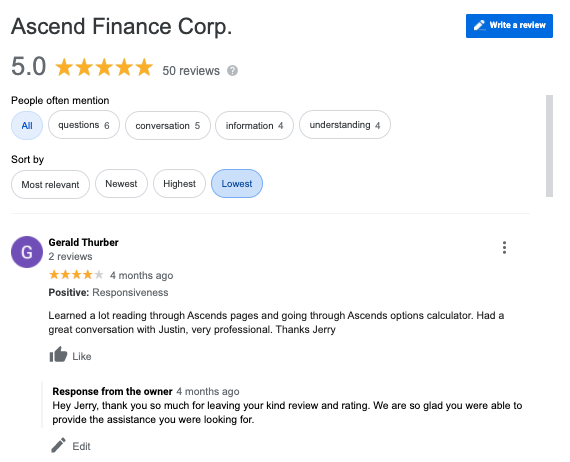

Some of the ways that you can determine this is potentially through rating and reviews because that gives you insight into other clients’ experiences. There are biased review sources out there, so our favorite review sites are Google ratings and reviews and Yelp ratings and reviews.

We like to sort from the lowest review descending so that you can really get a sense of whether this individual is reliable. See the image before of Ascend Bankruptcy Help’s Google reviews (source), with the lowest rating descending.

Filing bankruptcy in Howard is a big decision, so it’s important to have a reputable bankruptcy lawyer if you decide to hire one.

The purpose of this article was to show you top bankruptcy attorneys in Howard while providing some insights on how to find a reputable bankruptcy lawyer. For example, you may consider looking at the rate, the reviews and ratings, the reliability, the relevancy, and any referrals to decide whether to hire a bankruptcy attorney. You can also contact us at any time for specific questions about bankruptcy attorneys in Howard or take our free bankruptcy cost and qualification calculator below.