Written by Ascend Team

Updated Nov 1st, 2023

Did Quick Start Financial prequalify you for a loan with a 6.99% interest rate (similar to the one below)? Did you apply and get rejected for the loan, but you got approved for a debt consolidation program (aka debt forgiveness / debt resolution / debt relief / debt reduction / debt negotiation / debt settlement / debt arbitration program, the list goes on and on)? It is possible this is a common bait and switch tactic, but let's research to find out. What is Quick Start Financial?

I could not find much helpful information on Quick Start's website, but it appears as though they may offer loans through third parties.

It appears that they have a notice at the bottom of their website that mentions the loans are funded by a third party and they do not have control over the creditworthiness for the third party.

If you are looking for a loan, we have 2 debt consolidation loan options that we like that do not affect your credit score when checking rate and do not charge prepayment penalties.

Important Distinction: Loans vs Programs

A debt consolidation loan and program can be helpful depending on your situation. A lot of companies will market a loan but actually push you into a debt settlement program. It is very helpful to know the difference.

Loans:

- Proceeds for the loan will go into your bank account

- Generally has a fixed interest rate

- May see your credit score improve if you keep up with payments

- Creditors do not sue (accounts stay current)

Programs:

- Set up an escrow account where monthly payments are deposited from. You will not receive funds into your account

- No fixed interest rate, but rather interest and fees continue to build until the account is charged off

- Potential for severe damage on your credit score

- Fall behind on accounts (typically 90-120 days, but may be more)

- Potential to pay taxes on forgiven debt

Quick Start Financial History

I found Quick Start Financial on WayBack Machine, where it looks like they first started appearing in September of 2023. This means they are definitely a new business.

How Much Do Debt Consolidation Programs Cost?

At Ascend, we believe that debt consolidation programs (debt relief) may be a good option, but often in context in understanding all the costs and duration estimates of all your options. As such we built the free debt consolidation program cost calculator below to help you compare your current monthly obligations to a debt consolidation program.

Quick Start Financial Reviews

Reading reviews for debt relief companies can be incredibly helpful. Because Quick Start Financial is such a new company, I am unsure if I will be able to find any reviews.

BBB

Unfortunately I was unable to find Quick Start on BBB. I only found companies with somewhat similar names.

Google Reviews

Similar to BBB, I was unable to find any Google reviews for Quick Start.

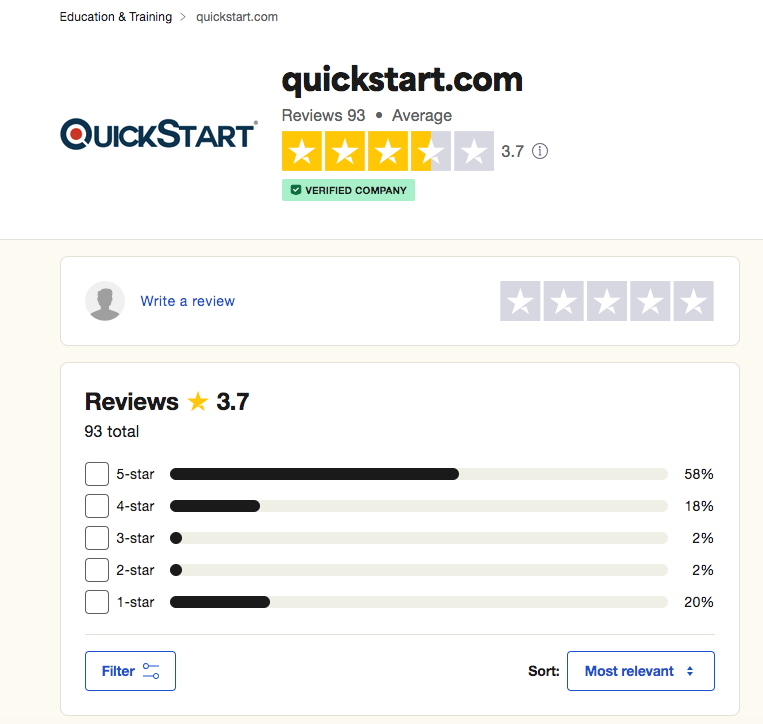

TrustPilot Reviews

On TrustPilot, I found a Quick Start, but it was not the same one related to debt relief.

Alternative Options to Quick Start Financial

Many people prefer to try to get a debt consolidation loan before looking at options such as debt management, debt payoff planning, debt settlement or bankruptcy. If you've searched far and wide for a loan and can qualify, consider taking the free debt consolidation program cost calculator below that allows you to compare to other options.