If you’ve been scrolling through TikTok, Instagram or Facebook lately, there is a high chance you have seen an ad from TurboDebt. An example ad below features an excited man walking outside and explaining how TurboDebt can save you from financial ruin. He promises that your credit score won’t be ruined and that you won’t have to pay back what you borrow. It all sounds way too good to be true — and, unfortunately, it may be.

If you haven't seen it, here's the example below.

So what exactly is TurboDebt? Why are they able to make these claims?

That is exactly what we are going to look at. Keep reading to discover the truth behind TurboDebt’s outrageous promises and learn what they really do instead.

On the surface, TurboDebt markets itself as either a debt relief company or a marketing firm for other debt relief companies that specializes in debt settlement. Debt settlement is the process in which a third party negotiates with your creditor on your behalf. The goal of a debt settlement firm is to find a lower payment that will fully satisfy the debt that you owe.

Debt settlement may be a great option for you, but it’s helpful to understand each of your options including non-profit credit counseling, and bankruptcy as there are definite cons to debt settlement. Here are some of the key cons to consider:

Now, if you are struggling with making payments on your debt and wondering what to do next, we built a free, unbiased debt options comparison calculator (not even an email address is required) that provides a wide range of debt options that may be able to fit your budget. The data is personalized to your income and expenses, so you can get accurate costs, pros and cons, and options.

Let's next cover Turbo Debt's history.

TurboDebt appears to be a newer entity.

In an earlier article, we did a deep dive into TurboDebt’s history, and learned that the company only has a digital presence that dates back to March 24, 2020. This means that TurboDebt is just over two and a half years when this article was updated. The brevity of the company’s history is interesting when compared to the amount of reviews it has.

In fact, TurboDebt has amassed almost as many Google reviews in 2 years as National Debt Relief acquired over a span of 13 years. With over 2,000 reviews, TurboDebt has earned a 4.9 out of 5 star rating on Google. In addition, Turbo Debt commands over 3,900 reviews on TrustPilot with the most recent reviewing coming today, and the oldest positive review from August 26, 2021. Also, at the time of this writing, I could not find any TurboDebt BBB accreditation.

So, you're probably wondering how much debt relief companies like TurboDebt may cost you each month.

At Ascend, we believe that debt settlement may be a good option, but it’s only in the context of understanding all of your options and understanding the cost of that option. This is exactly why we built a free debt relief cost comparison calculator so that you are MOST informed.

We know that TurboDebt refers you to other debt relief companies that may cost between 20-25% of enrolled debt, which can be quite expensive. Check out how much that will cost using our free debt relief cost calculator below that will estimate your MONTHLY payment that you can compare to what you're paying now.

If you ALREADY got a quote from TurboDebt, compare that quote to other companies that provide the same service. You may be surprised by how much you will save by just working with a different company.

However, are those Turbo Debt reviews well-earned? Let’s take a look at the cost and how TurboDebt reviews function.

According to TurboDebt's Google My Business Page, Turbo Debt is an exclusive partner of National Debt Relief, which means that TurboDebt refers you to National Debt Relief and potentially earns a commission. So, in order to understand what your full experience may be, it could really be helpful to read the National Debt Relief reviews.

Let's understand TurboDebt reviews and how the company may function.

The Turbo Debt reviews are extremely positive. One question is when did Turbo Debt request a review from the individual? Is TurboDebt requesting a review after you've just been promised that your debt burden will be eliminated?

If you are considering debt relief, you may consider the following:

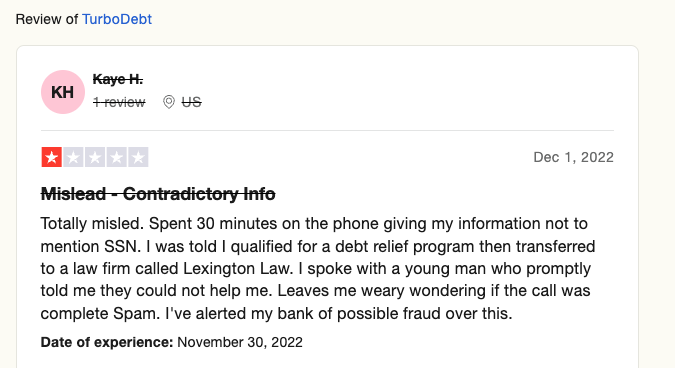

It may be helpful to review specific Trustpilot reviews. For example, take this example where the individual was attempting to transfer someone to Lexington Law, only to not qualify.

If you're working with National Debt Relief, it could be helpful to review National Debt Relief's 254 BBB complaints in the last 3 years or one of our articles coveering National Debt relief.

Let's look at a review where Heather got connected to Turbo Debt to get placed into the National Debt Relief program.

For example, check out this recent Trust Pilot review.

There are many reviews on Google from confused clients who thought they were going to work with TurboDebt. However, they quickly got handed off to another company. According to TurboDebt’s own website, their goal is to “connect clients to debt relief programs that fit their unique needs.” This means that TurboDebt’s function is essentially to market to the population, find relevant leads, and match them to one of the companies they are partnered with.

Most likely, this means that TurboDebt makes money off of sponsorships from its partnered companies. Unfortunately, when company recommendations are tied to profit, two things are likely:

There may be a period of time where you actually work with TurboDebt, but that will only be spent figuring out which company to work with. Once the connection has been made, it is likely you will not be in contact with TurboDebt again. Even if you do get back in touch with TurboDebt, they will not have any information on how your case is being handled.

In short, no, you will not be working extensively with TurboDebt.

Unfortunately, their claims that your credit score will not be impacted and you won’t have to pay them anything may not tell you the full story.

Technically speaking, since they are just the middle-man that connects you to a debt settlement company, they can make their big claims. This is because their free consultation only matches you to a company and does not actually interfere with your financial accounts.

So while, yes, technically your credit score won’t be hurt and you won’t have to pay them back, the claim still instills a sense that these are true for debt settlement as a whole. At the end of the day, TurboDebt connects individuals to debt settlement programs. Debt settlement DOES in fact lower your credit score significantly and is not without cost. In most cases, you will still owe a percentage of your debt as well as a fee to the company who negotiates the debt on your behalf.

If TurboDebt isn’t what you thought it was, and you are still looking for debt relief options, you still have some choices! Depending on where you are at in your debt relief journey, there are many things you can do. Here are just a few examples:

If the lack of credit score impact and no extra payments intrigued you, then consider looking into debt management. There is still a chance that your credit score will be slightly impacted, but not nearly as bad as some of the other debt relief options. Basically, debt management allows you to look at your debt payments as a whole and break them down into more manageable and organized payments. Sometimes this includes asking your creditors for smaller payments, or a break in payments, but you will still be paying off the entirety of the debt.

Ultimately, TurboDebt is connecting you to a debt settlement firm. However, your rate may be inflated because of the cost of customer acquisition is high. Instead, do research on the best debt settlement companies and contact them yourself! While your credit score may still be impacted, you could potentially save a little bit on the cost.

If paying off your debt isn’t an option, then bankruptcy might be your best bet. While you will definitely see a drop in your credit score, there is a chance that bankruptcy is the lowest cost option you have.

The free debt relief cost calculator provides a personalized estimate of each of these options based on your unique expenses.

Overall, TurboDebt is a marketing company that refers individuals to National Debt Relief.

Make sure you understand what TurboDebt is before you begin working with them. If you would like to talk to someone about options, give me a call at 833-272-3631! We love giving accurate and unbiased information that can help you make a decision based on your unique situation!